Category:

Personal Finance

About Credit Card Hardship Programs Generally speaking, Americans are late in paying off credit card balances and the situation could get far worse after the devastating fallout from the coronavirus.…

Getting laid off is traumatic, but at least I got the bad news in a fitting place. I was in a doctor’s office when my cellphone rang. It was my…

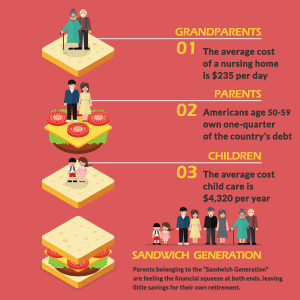

American culture has created names for various age groups based on when they were born. Baby Boomers. Millennials. Generations X and Y. But another demographic has emerged based on what’s…

What to Do When You Can’t Afford Credit Card Payments What happens when just meeting the minimum payments is beyond your means and you’ve come to the tough realization you…

The “Statute of Limitations” for credit card debt is a law limiting the amount of time lenders and collection agencies have to sue consumers for nonpayment. That time frame is set by…

If you’re contemplating a divorce, you may be wondering: how will credit card debt be divided? There are several factors that can influence who pays. Whose name is it in?…

Debt is a threat to the retirement plans of almost every American. A recent study by Lending Tree showed that just about every senior carries debt into their early retirement…

First job? Congratulations! Welcome to the workforce! First paycheck? You have some planning to do. Paychecks are your ticket to join – and enjoy – America’s economy, but there are…

Borrower beware! If you are hoping to score a car or home loan and don’t know your debt-to-income ratio, you probably want to check into it. You might find out…

A disturbing number of Americans are speeding toward a financial cliff called retirement. Unless they change their saving habits, they may well barrel over the edge and land in poverty.…

Sources:

- Nye, M. (2019, April 17) How a hardship plan can affect your credit. Retrieved from https://www.creditkarma.com/credit-cards/i/how-hardship-plan-can-affect-credit/

- Mohammad, L. (2019, May 1) Comparing Secured Credit Card Offers. Retrieved from https://www.creditcards.com/secured/#long-term-debt-poll

- (2018, October 23) Paying off Closed or Charged off Accounts. Retrieved from https://www.experian.com/blogs/ask-experian/paying-off-closed-or-charged-off-accounts/