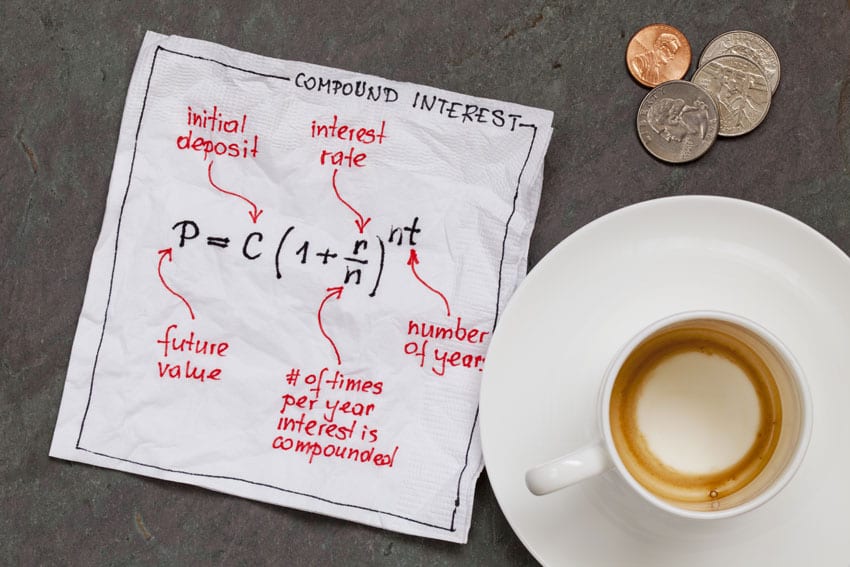

Introduction to Compound Interest

Find out if nonprofit debt payment consolidation is right for you.

Get Your Free Debt Analysis Online or call [vdn].

The Power Of Compounding

I wish I had learned about the power of compounding a long time ago. As a kid I walked dogs in the neighborhood, earning $5 a week. If I’d started investing that weekly $5 from age nine until 65, it would have grown to $254,000, assuming an 8 percent return.

Unfortunately, I didn’t catch compounding fever until much later. I missed out on maximizing my first few years of 401(k) contributions, which would have made a huge difference at retirement.

But on a positive note, my 11-year-old son learned from my mistakes and socks away his $10 weekly newspaper delivery salary, which he earns in addition to his allowance. My wife and I sweeten the pot by matching his savings in a Roth IRA we opened for him.

So what is compounding? Basically, it’s where you put aside money – whether in savings, a retirement account or the stock market – and then essentially leave it alone. As your account earns interest or dividends, you continually reinvest those profits, thereby generating (compounding) additional earnings at an accelerated rate.

Numerous interactive calculators are available online to help you estimate potential savings under different scenarios. I used several from the website Dinkytown (www.dinkytown.net) in the following examples:

Using Dinkytown’s “Compound Interest and Your Return” calculator, you can estimate how quickly a one-time investment will grow at varying interest rates and periods of time. For example, a $10,000 investment earning 8 percent compounded quarterly would be worth $22,080 after 10 years; $48,754 after 20 years; and $107,652 after 30 years.

If you can set money aside every month, your savings will grow even faster. According to Dinkytown’s “Cool Million” calculator, if you began saving $100 a month at age 21 and earned 8 percent interest, by 65 your account would be worth about $447,000. Increasing the monthly contribution to $200 would double that to about $893,000.

The riskier the investment, the greater your potential gains – and losses. For example, regular savings accounts typically offer very low interest rates in exchange for very low risk of loss. On the other hand, investing in the stock market can potentially earn double-digit investment rates over long periods of time. (Of course, stocks can be a risky short-term investment.)

So why not simply park your money in a safe haven? Simple: inflation. If your money is earning 2 percent interest but the inflation rate is 3 percent, you’ll actually net a 1 percent loss.

Using the “Cool Million” $100-a-month example above, if you expect to earn 8 percent interest but factor in a 3.1 percent expected annual inflation rate (the overall average rate since 1925), your account balance at age 65 would be worth more like $117,000 in today’s dollars, versus $447,000 unadjusted for inflation.

The longer you delay saving, the harder it is to catch up. According to Dinkytown’s “Don’t Delay Your Savings!” calculator, if you save $200 a month at 8 percent interest, after 30 years your account would be worth $283,522. But wait only two years to begin saving and that balance would shrink to only $238,612 – that’s $44,910 less. A five-year delay would knock it down to only $182,968.

Bottom line: Don’t procrastinate on starting to save. And get your kids on the compounding bandwagon as well; they’ll thank you once they reach your age.

Article courtesy of Visa Financial. By Jason Alderman