How To Create a Successful Budget

With surveys showing that most households lack sufficient savings to pay for a $1,000 emergency, and large numbers of Americans struggling with debt, the value of creating and following a budget has never been clearer.

Creating a household budget can serve many purposes: getting out of credit card debt faster, saving for a long-term goal such as a house or retirement, or simply ensuring that you are on solid financial footing to meet whatever curveballs life may throw at you. The evidence that budgeting works is clear-cut: Surveys show that those who stick to budgets are less likely to report financial worries or living paycheck to paycheck and more likely to achieve their financial goals.

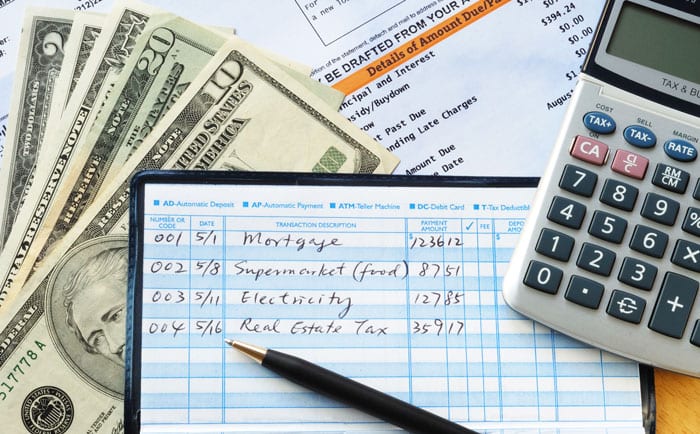

So, what exactly is budgeting? At its simplest, it’s a ledger detailing the spending decisions you intend to make. It estimates how much money will come in during the months ahead, and it allocates enough money to cover expenditures such as food, housing, transportation and insurance.

A good budget also includes allocations for regular savings. In essence, a budget not only lays out a path for reaching a particular financial destination but also acts as a flashlight to shine the way and ensure that you don’t wander off course. Without one, you’re more likely to find yourself in the dark about your financial health and lost in the wilderness of debt and financial insecurity.

Is it any wonder then that more Americans are turning to budgeting in their search for financial bliss? And while a budget won’t be able to buy you love, to paraphrase The Beatles, a side benefit of budgeting might be to mitigate a common source of strife and strain in relationships: disagreements over money.

Why Budgeting Is Important

Even as the national economy was enjoying one of its longest-ever periods of growth in 2018, a survey by Bankrate showed that nearly two-thirds of Americans were limiting their spending each month. And with economic fortunes changing rapidly, that number is only likely to grow.

Stagnant incomes, growing debt burdens and rising housing and medical costs are among the reasons so many Americans have looked to tighten their financial belts in recent years, regardless of what the GDP and employment figures say. But just as it’s difficult to shed pounds when you don’t know how many calories you’re consuming, it’s equally difficult to cut the fat out of your spending and whip your finances into shape without a budget to shine a light on where your money is currently going.

Here are just a few of the reasons that creating a household budget is a wise decision, regardless of your financial circumstances:

- Simple and effective way of managing or avoiding debt: The reason millions of Americans find themselves weighed down with hefty interest payments on credit card accounts is that they simply spend more each month than they bring in, and hence they are unable to pay off their card balances. The No. 1 budgeting tip: Make sure your monthly spending does not exceed your disposable income.

- Helps achieve short and long term goals: Say you want to save money for a down payment on a car next year or a home in five years, or that you want to make sure you can spend your golden years in comfort by building up your retirement nest egg. A budget plays a valuable role in determining how much of your income you need to save each month to reach those goals and how to allocate that money accordingly. A budget is a way of forcing you to make sacrifices – be it cutting back on lattes at Starbucks or restaurant meals, scaling back expensive vacations, settling for a cheaper cable TV package, or holding onto that aging car for a few more years. A budge is also a way of helping you anticipate expenses like car expenses, utilities, or phone bills.

- Can prepare you for a rainy day: The fact so many Americans live paycheck to paycheck, and so few have an emergency fund, cries out for the need for more households to build a cushion they can turn to the next time the car breaks down, the home plumbing springs a leak, or, in a worst case scenario, you lose your job or health insurance.

- Encourages you to become invested in your own finances: Simply put, the process of budgeting instills individuals with the discipline and motivation to manage their finances more efficiently and responsibly. Research has shown that those who adhere to a budget are more likely to reach their financial goals in part because they become emotionally invested in the process.

» Learn More: Budgeting Tips for Families

Steps in the Monthly Budgeting Process

There is no one universal method or tool for budgeting; you’ll most likely choose an approach that fits most comfortably with your skills and preferences, whether it’s budgeting apps such as Mint, programs like Quicken, a budget worksheet such as the one provided by InCharge Debt Solutions, or an old-fashioned pencil and paper. To help with the math, you can also try InCharge’s budget calculator.

» More:

Whichever approach you choose, you’ll need to follow some basic steps to make sure you’re creating a clear and accurate picture of your finances.

Gathering Financial Statements

This is as basic as collecting every document that reflects your monthly income and expenses, including bank, credit card and investment accounts, paycheck stubs, benefits statements and electronic payments. The strength of a budget will be determined by how accurate it is. Look at three months of credit card and/or debit card charges to make sure you are capturing all of the categories where you typically spend money.

While some of these income and spending items may vary from month to month, or reflect one-time or irregular transactions, gathering a paper trail is the best way to get a bird’s-eye view of how much money is coming into and leaving your financial house each month. Then you can start drilling down into the nitty gritty of creating a budget that puts that house on a firm foundation for the future.

» Learn More: Financial Planning Process

How to Calculate Monthly Income

When it comes to a budget, take-home income is the only income that matters. Forget about pre-tax earnings. Your take-home pay is what you can spend or save beyond what you may already be putting into a retirement account at work.

When calculating income, also include other sources like social security, disability, pension, child support, regular interest or dividend earnings and alimony. Any money that you regularly receive can be considered income for your monthly budget.

Here’s how to determine what your monthly take-home income is:

If You Are Paid Bi-Weekly: Multiply your take-home pay for one paycheck by the number of paychecks in a year: 26. Then divide this number by 12 to get your monthly income.

If You Are Paid Weekly: Take your weekly pay and multiply it by the number of weeks in a year: 52. Divide this number by 12 to get your monthly income.

If Your Pay Fluctuates: If your pay fluctuates based off tips, varying hours and/or commissions, you can still calculate an estimated monthly income by adding up three months of income and then dividing by three.

» Learn More: How to Budget Money on a Low Income

List All Your Monthly Expenses

Once you’ve collected all relevant financial statements and other documents, you’re now in a position to confidently calculate your average monthly expenses, from mortgage payments, rent and car loans to utility bills, insurance, prescriptions, groceries, dining out and student and other loans. Don’t forget to account for irregular bills that you may pay annually or semi-annually, such as property taxes and car registration and insurance fees.

Tracking your spending in different categories can help you get a better sense of which areas are consuming significant chunks of your income. The Consumer Financial Protection Bureau provides a handy spending tracker worksheet to simplify the process.

» Learn More: List of Typical Monthly Expenses

Categorize Expenses as Fixed or Variable

To determine how much wiggle room you will have to adjust your budget to meet specific goals, you first need to figure out which expenses are fixed and which are variable.

Fixed expenses are those payments that remain relatively consistent from month to month. They often reflect “needs” rather than “wants,” though some categories fall into gray areas. The more of your overall budget that is consumed by fixed costs, the less flexibility you will have to make adjustments absent some big lifestyle changes (such as selling your car, taking on a roommate or moving to a city with a lower cost of living).

Examples of fixed expenses:

- Mortgage/rent

- Car payments

- Car insurance

- Health insurance

- Utility bills

- Internet, TV and cell phone service

» Learn More:

Variable expenses, on the other hand, differ significantly from month to month based on your lifestyle, choices and spending habits. They are typically classified as the “wants” in your life and therefore can be adjusted more easily and reallocated in your budget depending on your individual goals — whether it’s to pay down debt, save for a big-ticket purchase or build up a rainy day fund.

Examples of variable expenses:

- Travel

- Dining

- Gifts

- Entertainment

Add Up Income(s) and Expenses Columns

Now that you’ve documented all your expenses and income, it’s time to add up each column and face the music: If your income exceeds your expenses, you might want to whistle the Kingston Trio’s “Put Your Money Away” as you decide how best to deploy that excess cash. If, on the other hand, your expenses outstrip your income, it’s time for a more sobering tune like Destiny Child’s “Bills, Bills, Bills” or Lou Reed’s “The Debt I Owe” and some hard choices. Budgeted expenses should never exceed 90% of your take-home income.

But don’t let that sad song get you too down. By adding up your income and expenses, and seeing where the difference lies, you’ve taken the most important step yet to creating a budget that will allow you one day to sing “Happy Days Are Here Again.”

» Learn More: How to Live on One Income

Evaluate Results and Adjust Accordingly

Getting a handle on your income and expenses can be eye-opening, humbling and empowering all at the same time.

You may discover that you’re in a better position to save than you had anticipated, and that you have the means to reach that long-term goal of a new home or car with the right plan and discipline. Or you may discover that too much of your money is going toward variable expenses like expensive meals, clothes or shows that you can easily live without, providing the kick-start you need to trim back your spending to build up a rainy day fund or save for retirement. And if your fears come true, and you learn that you’ve been living beyond your means, you now have the information to make the choices necessary to repair that crumbling foundation.

Whatever the results show, your job now is to create a budget in which the amount you’re setting aside each month for variable and fixed expenses and short- and long-term savings goals matches what you’re bringing home in income.

Start by trimming back variable expenses if you need to or looking for ways to boost your income with a side hustle or safe investment that pays regular dividends or interest. If that’s not enough, look for what adjustments are possible to your fixed expenses. Can you shop around for a cheaper auto insurance plan? Cut the cord with your cable TV provider? Or if necessary, downsize to a cheaper home, apartment or car?

It’s also important to make sure your budget tracks due dates for bills so that you don’t risk missing payments and racking up late charges or other penalties, which will quickly throw your budget out of whack. Consider setting up automatic payments for recurring bills and/or incorporating a bill calendar into your budget to keep tabs on due dates and ensure that your income flow is sufficient to cover individual payments each month; the Consumer Financial Protection Bureau provides a sample here.

» Learn More: Budgeting Tips for Beginners

50/30/20 Rule

Deciding to create a budget, and calculating your income and expenses, is only half the battle. If you don’t ultimately set the right the goals in your budget for financial health, the endeavor will be a failure. One key to making the process pay off is choosing the right budgeting approach for allocating your income.

One approach that has grown in popularity in recent years is the 50-30-20 rule pioneered by U.S. Sen. Elizabeth Warren, D-Massachusetts, in her book, “All Your Worth: The Ultimate Lifetime Money Plan.”

The approach’s popularity can be found in its simplicity: You divide your income into three pots and allocate it according to the following percentages: 50% goes toward “needs,” such as rent, food and minimum payments on credit cards and other debt; 30% for “wants” such as trips or entertainment; and the remaining 20% toward savings, which can include debt repayment. Your savings should include an emergency fund that can cover at least three months of expenses should you lose your job or suffer another blow to your income.

Of course, most rules come with exceptions, and that is also true with the 50-30-20 model. For low-income households that are saddled with debt, it may be necessary to devote a higher percentage of income to “needs” and less to wants and savings, at least temporarily. Similarly, if more affluent households can afford to squirrel away more than 20% in savings, that might be a better use of income in the long run that buying a new Mercedes, booking that five-star European hotel or upgrading to a more spacious home. And if you’re already devoting a healthy chunk of your pre-tax income to a 401(k) plan or other employment retirement vehicle, you’ll want to take that into account as well in setting your savings goal.

» Learn More: How Much Should You Save From Each Paycheck?

The 50-30-20 allocation may also need to be adjusted from time to time to account for emergencies or unexpected expenses, such as a roof repair or big medical bills. But while no rule is set in stone, the 50-30-20 model can work exceptionally well as a tried-and-true rule of thumb.

Budgeting Tips

- Don’t confuse luxuries with necessities. Eating is a necessity. Eating at a four-star restaurant is a luxury. If you have to trim expenses, pare back on the luxuries.

- Watch the small stuff. If you like passing time in coffee shops, add up what you spend each month. The sum of all those $4 lattes might shock you. So drink water sometimes, or work at home and make your own coffee.

- Restrain yourself. Just because you earn a raise doesn’t mean you have to find new ways to spend money. Consider saving part of it or contributing more to a workplace 401(k) retirement plan.

- Use cash. Credit and debit cards are great conveniences, but also easy to overuse. When you spend cash, or write checks and enter them in a register, you’ll more accurately see what your dong with your money. Finally, using cash isn’t an excuse to visit an ATM when you get the urge to spend. Use your budget to set limits on yourself and keep receipts to monitor your progress. Envelope budgeting is a great system if you’re planning to go with a cash-based method of managing your finances.

- Manage your own debt. If you have a growing unpaid balance on your credit cards, part of your budget should aim at bringing the balance to zero. Paying revolving credit card debt is one of the least useful ways to spend your money.

- If your debt is out of control, consider debt consolidation programs that lower your interest rate and your monthly payment.

» Learn More: How to Lower Your Cell Phone Bill

Budget Calculator

Using a budget calculator can help you quickly add up your income and expenses. InCharge’s online budget calculator will help you capture all of your expenses and assess what income is required to maintain your expenses.

Budget Spreadsheet

A spreadsheet is a good tool to use while budgeting because you can change your assumptions and see how they affect your surplus and/or deficit. A well-designed budget spreadsheet will have formulas pre-programmed to add up your expenses and subtract them from your income. You can see how reducing costs 5-10 percent across small areas of your budget add up to larger savings.

When maintaining a budget spreadsheet, consider having two: one spreadsheet reflecting your actual income and expenses and a duplicate that reflects your goals: expenses you are working on reducing (monthly debt payments, for example) and income opportunities you are working to grow. Your goal budget can help you visualize the power of savings over time. Remember, any expense you are able to reduce permanently represents recurrent savings: savings times twelve months in the year.

Download InCharge’s Budget Spreadsheet

You will need Adobe Reader to view the PDF Download Adobe Reader

Discuss Your Budget with a Credit Counselor

While there are plenty of resources available to help you get started with creating and sticking to a budget that will put you on the path to your financial goals, the process can still seem overwhelming, especially for those who are already struggling with debt or other challenges. If that’s the case, free credit counseling such as that provided by InCharge Debt Solutions can be the answer.

Credit counselors can provide personalized recommendations on trimming expenses and boosting income in each major budget category, as well as help with debt-relief programs such as a debt management plan or debt consolidation that may be an important component in making your budget work.

A budget can’t work miracles. It can’t make money grow on trees, force your boss to give you a raise or control how much that next car or vacation will set you back. But it can make a significant difference in your financial health, which may also carry over to your emotional and physical health. At the end of the day, a well-planned and executed budget may accomplish for you what the Rolling Stones sang about in their hit “Can’t Always Get What You Want.”

“You can’t always get what you want

But if you try sometimes

You just might find

You get what you need.”

Sources:

- Dantus, C. (2019, June 5) “Budgeting: How to Create a Budget and Stick With It” Retrieved from https://www.consumerfinance.gov/about-us/blog/budgeting-how-to-create-a-budget-and-stick-with-it/

- Whiteside, E. (2020, April 5) “What is the 50/30/20 Budget Rule” Retrieved from https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- Vohwinkle, J. (2020, March 6) “Make a Personal Budget in 6 Steps” Retrieved from https://www.thebalance.com/how-to-make-a-budget-1289587

- Smith, K.A. (2018, October 17) “Two Thirds of Americans Are Limiting Their Spending, and This is the Main Reason” Retrieved from https://www.bankrate.com/banking/savings/financial-security-october-2018/

- Bieber, C. (2018, June 4) “Budgeting 101: How to Start Budgeting for the First Time” Retrieved from https://www.fool.com/investing/2018/04/21/budgeting-101-how-to-start-budgeting-for-the-first.aspx

- N.A. (ND) “Debt.com’s 2020 Budgeting Survey Reveals More Americans Than Ever Are Budgeting” Retrieved from https://www.debt.com/research/best-way-to-budget-2019/