How To Save Money On Homeowner’s Insurance

If you want to save money on your homeowners insurance —who doesn’t? — there are numerous common-sense methods to position yourself for the best rates.

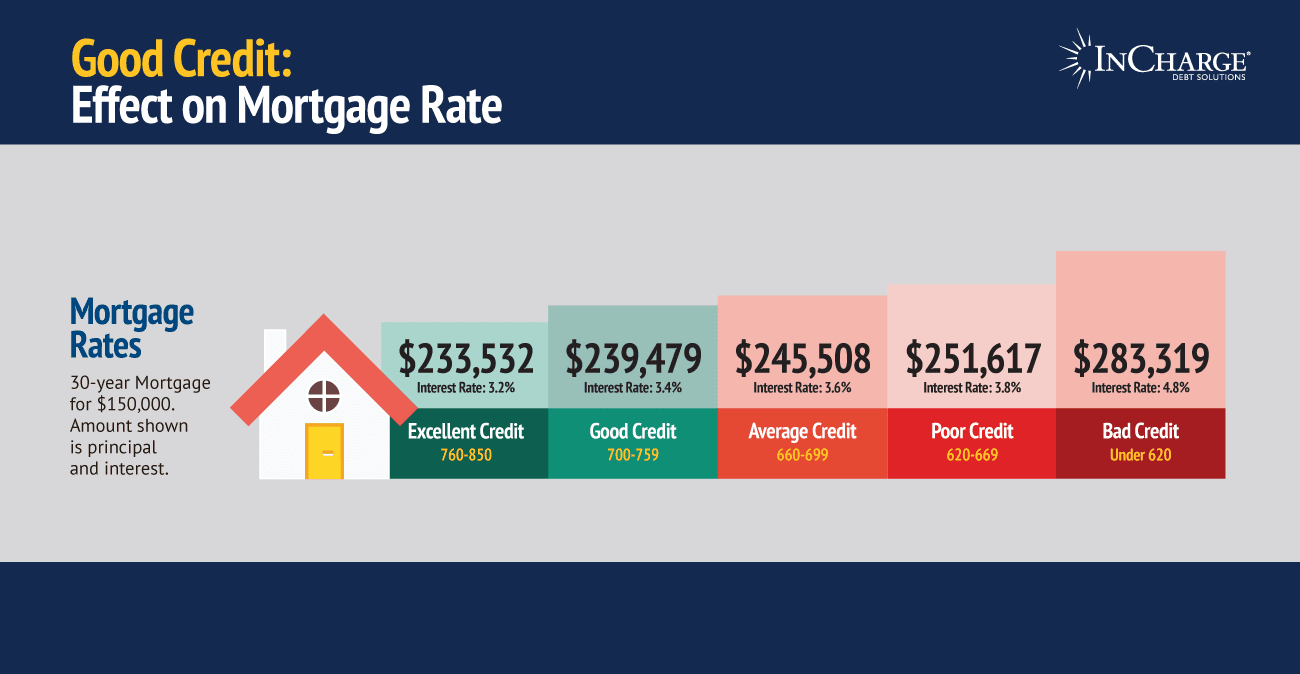

Chief among them: Protect your credit score.

In other words, pay your bills on time, keep your credit card balances low (or eliminate credit card debt altogether), don’t seek cash advances and check your credit report regularly to make sure there aren’t any errors.

“There are many things that factor into a policy premium, but credit score is a big one,’’ said Michal Brower, spokesperson for State Farm Insurance Agency in Florida. “Time has shown that a credit score is a very accurate predictor of risk and it quite often reflects the type of policy rates that a person will qualify for.’’

The overall outlook for homeowners’ insurance is also reflected in the old real-estate credo — location, location, location. Where you live will play a major role in the overall premiums.

According to ValuePenguin, a personal finance website, the average annual American homeowners’ insurance premium is $952.

The highest average premiums exist in Florida ($1,991 or 109% higher than the national average), Louisiana ($1,722), Texas ($1,625), Mississippi ($1,451) and Oklahoma ($1,428). Not coincidentally, the first four states have coastal areas off the Gulf of Mexico of Atlantic Ocean that are threatened by hurricanes. Oklahoma has more tornadoes per square mile than anywhere else in America.

The lowest average premiums are in Idaho ($534 or 44% lower than the national average), Oregon ($576), Utah ($580), Wisconsin ($610) and Washington ($645).

The middle ground is represented by Alaska (exactly $952), then New Jersey and Tennessee (each at $942).

“If you are moving somewhere for a job or with your family, for sure, it’s something to consider,’’ Brower said. “Just like the cost of living could vary, this is more information you should be aware of.’’

Home location also influences the credit score importance.

According to Insurancquotes.com, in 37 states in the U.S., consumers with a poor credit score pay at least twice as much for their home insurance as consumers with an excellent credit score. If you live in West Virginia and have poor credit, your homeowners’ insurance will cost approximately 208 percent more than someone who has excellent credit.

“This is another example of why credit is such an important part of your financial life,’’ said Laura Adams, a personal finance expert and best-selling author. “If you maintain a good credit history, it suggests that you’re a less risky customer and it can lead to several hundred dollars in savings (for homeowners’ insurance). On the other side, insurers have found that people with poor credit records tend to make more claims.’’

“This is another example of why credit is such an important part of your financial life,’’ said Laura Adams, a personal finance expert and best-selling author. “If you maintain a good credit history, it suggests that you’re a less risky customer and it can lead to several hundred dollars in savings (for homeowners’ insurance). On the other side, insurers have found that people with poor credit records tend to make more claims.’’

5 Ways To Save On Homeowner’s Insurance

- Raise your deductible: Typically, an insurance company will recommend a $500 deductible, the amount of money the consumer pays for a claim before the insurance money kicks in. By raising the deductible to $1,000, consumers can save up to 25% on their premium.

- Bundle: Most insurers offer discounts of 5% to 15% if you purchase homeowners and auto policies from the same company. Be smart, though. Make sure you get a lower price with the combined purchase (instead of two different policies from different companies).

- Ask for discounts: There are generally 5% discounts available for a burglar alarm, smoke detector and dead-bolt locks. If you live near the fire station — or have an alarm that rings at monitoring stations — your premium should be reduced. Many companies offer discounts for older people — over 55 or retired — because they are more likely to be at home to spot potential fires or discourage burglary attempts.

- Shop around (but stay loyal if you can): A thorough investigation of all insurance sources will usually turn up your best financial option. Also check out the National Association of Insurance Commissioners (naic.com), which has a bevy of information, including complaints against the companies. Once you find the best insurance value, it might be best to stay with that company. Some offer 10 percent discounts for policyholders of six years or more. Take advantage of those discounts.

- Improve your home: A new roof, storm shutters or retrofitting for older homes could prove beneficial. To reduce the risk of fire or water damage, consider modernizing the homes heating, plumbing and electrical systems.

“It’s like anything,’’ Brower said. “The more information and awareness you have, the better off you’ll probably be.’’

Sources:

- NA, (2016), Average Cost of Homeowners Insurance, ValuePenguin. https://www.valuepenguin.com/average-cost-of-homeowners-insurance

- NA, (14 August, 2014), How Much Credit Score Affects Home Insurance Varies By State, Insurance Journal. http://www.insurancejournal.com/news/national/2014/08/14/337527.htm

- Adams, L., (15 January, 2014), Money Girl: 5 Ways To Save Money on Home Insurance. http://www.quickanddirtytips.com/money-finance/insurance/5-ways-to-save-money-on-home-insurance