Student Loan and Credit Card Debt Statistics From The NFCS

American consumers are improving at paying off their credit-card balances, but experts say a new array of diverse products have complicated the financial goal-setting process.

More consumers, young and old, are paying on student loans every month and there is concern that the convenience of mobile payments will lead to even more undisciplined use of credit.

Paying Your Credit Card Balance In Full, The Data

- In the past six years, consistent full monthly payoffs of credit cards have increased from 41% to 52%

- People who made only minimum payments dropped from 40% to 32%, according to the 2015 National Financial Capability Study (NFCS).

Data on Expensive Behaviors: Late Fees, Over Limit Fees, Cash Advances

Nearly 40% of consumers still engage in “expensive’’ credit-card behaviors, such as making only the minimum payment, paying late fees, paying over-the-limit fees or using the card for cash advances.

Student Loan Debt Data

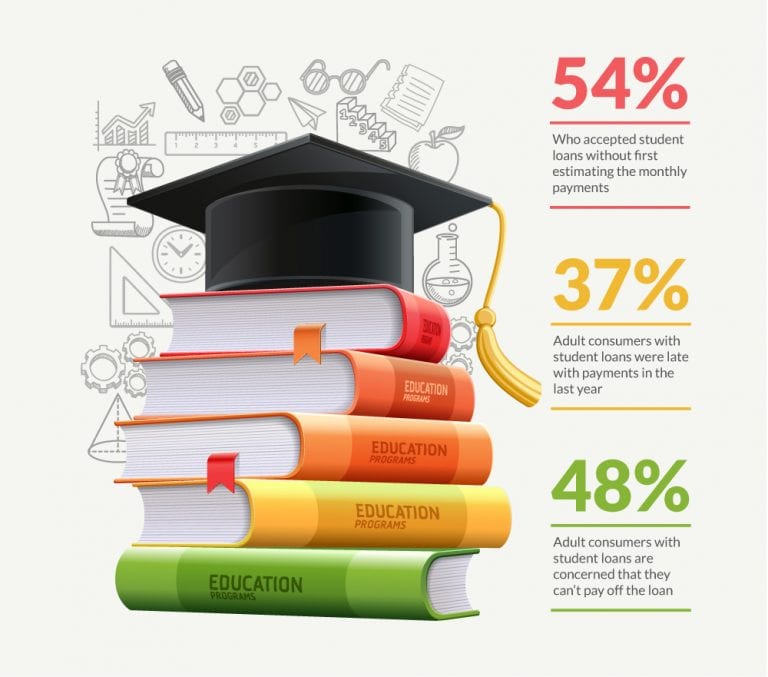

The problems with credit card use pales in comparison to student loan issues, according to the study, which was conducted by the FINRA Investor Education Foundation. The survey says that 54% of adult consumers with student loans accepted them without first estimating the monthly payments, 48% are concerned they can’t pay off the loan and 37% were late with payments in the last year.

Meanwhile, the 22% point-of-sale payments by mobile devices such as smart-phones should grow exponentially in the coming years, but experts caution against consumers being lulled into false security during the growth of an increasingly more common “cash-less’’ society.

“Young people are using a variety of financial instruments and this is what they get used to,’’ says George Washington University professor Annamaria Lusardi, an author of the study. “They carry credit card debt. They have a student loan. They start their economic life in debt and maybe they turn to alternative financial services, such as payday loans and pawn shops.

“They are highly leveraged. They keep bringing in other financial instruments. We see this behavior as a sign of mismanagement. This is a group that needs some financial education.’’

Home Ownership Rates In The United States By Demographic

- 60% of Americans own homes, but figures vary wildly across age and ethnic groups. In the 18-34 age category, only 38% are homeowners, while the figure doubles to 76% for people 55 and older. Overall, home-owner figures are just 47% for Hispanics and 43% for African-Americans, compared to 67% for whites. Financial resources for African Americans can help to improve homeownership rates.

- 9% of homeowners are “underwater’’ — owing more on their home than the potential sale price — but there is virtually no difference throughout income levels, suggesting an all-encompassing issue.

Debt Statistics

- 40% of Americans feel they have too much debt

- 18% of the respondents said they were contacted by a debt collection agency within the last year.

- The debt collection rates were particularly high among those with unpaid medical bills (55%), those who use non-bank borrowing (41%), those who have a student loan (31%), African-Americans (31%) and people with incomes less than $25,000 (25%)

Feelings About Credit

- 60% rate their credit as “good or very good’’ and the people providing those self-assessments are only 30% likely to have “bad or very bad’’ credit scores.

NFCS Study Methodology

The NFCS study polled 27,564 American adults and has been conducted every three years, starting in 2009. The study asks questions about four major areas of finances: Making ends meet; planning ahead; managing financial products; and financial knowledge and decision-making.

Other Data On Credit Card Habits

Despite the relative improvement in some credit card habits, a variety of studies indicate it remains a substantial problem. At the end of 2015, the Federal Reserve noted that Americans were carrying $935.6-billion in credit card debt. That figure has grown $100 billion since 2011, but it’s still less than the $1.02-trillion debt in 2008 at the onset of the Great Recession.

Average Credit Card Debt

On average, Americans between the ages of 18 and 65 have $4,717 in credit card debt (those who carry a balance).

Despite the minimum-payment figure dropping to 32% of Americans, financial expert Ric Edelman, author of eight books and host of a syndicated radio program on personal finance, said that one in three is still too many.

The Minimum Payment Mindset

“I’m constantly working to get that number to go down, but I don’t know that it ever will,’’ Edelman, the chairman and CEO of Edelman Financial Services, said.

“I remember counseling a couple and asking about their situation in monthly spending. They said they were doing fine. We found they owed $50,000 to in credit card debt. ‘Tell me why you’re fine,’ I said. And the wife said, ‘We’re able to make the (minimum) payments every month. We’re fine.’

“That’s the mindset we’re fighting. It’s frustrating.’’

Average Student Loan Debt at Graduation

Equally frustrating are the student loan figures, which paint a bleak picture for college graduates.

Average student loan debt at graduation has been growing steadily. In 1993-94, about half of bachelor’s degree recipients graduated with debt, averaging more than $10,000. This year, more than two-thirds of college graduates had debt. Their average student loan debt at graduation was $35,000, more than tripling in two decades.

“We have a lot of students — and people who are no longer students — who are struggling to understand their debt and how to best pay it off,’’ Gary Mottola, one of the authors of the NFCS study, said. “We ask in the report if people would do things differently. Almost 20 percent say they don’t know. These are people who are already paying back their loans and they still don’t understand the loans well enough to say whether they would do it again. That speaks to the complexity of the problem.’’

“It doesn’t seem like a problem when you consider people have debt, but they are investing in education, so there’s an asset correlated to the debt,’’ Lusardi says. “Managing the debt is the problem because it comes at a higher interest rate than the asset. Young people have to be savvy when they start their economic life in debt because that can raise all kinds of issues.’’

Mobile Payments

Just as student debt is commonplace for young people, so are technologies such as mobile payments. A wallet filled with dollar bills has been replaced by a smart-phone. It’s convenient. But Lusardi sees danger if that convenience comes without responsibility.

“We are moving toward a cash-less society and we already see places that don’t accept cash,’’ Lusardi says. “The downturn is what you don’t see, the idea that you can get money out of your phone. You might lose that connection to cost. Just because you’re paying with your phone doesn’t mean you’re not going to pay.

“If we’re not using cash, we need financial education more than ever. Money is still money. It still comes from the paycheck. The fact that we’re making it more mindless adds to the risk of mismanaging it. Moving forward, people must be very careful.’’

Sources:

- Kieffer, C., Lusardi, A., Mottola, G., Walsh, G., (2016), National Financial Capability Study, FINRA Education Foundation. Retrieved from http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf

- NA (2015), Board of Governors of the Federal Reserve System. Retrieved from http://www.federalreserve.gov/releases/g19/current/#fn3a

- Steverman, B. (2016, 9 February), Americans Can’t Help Themselves From Borrowing More On Credit Cards, Bloomberg News. Retrieved from http://www.bloomberg.com/news/articles/2016-02-09/americans-can-t-help-themselves-from-borrowing-more-on-credit-cards