Category:

Debt Relief

Bad credit has a huge negative impact on so many parts of your financial life. The impact isn’t just on what rates you pay on credit cards and loans, or…

Millions of Americans must deal with wrong information on their credit reports every year. Many of them hire someone to deal with it. That can be a colossal waste of…

Credit repair companies do work, but that may not be the full answer you need. In fact, the real question is whether you need a credit repair company at all?…

A home equity loan is money borrowed against the equity in your home. Your “equity” is the value of your home minus the amount you owe. The loan amount is…

What happens when you can’t afford to pay back your debt? Depending on your circumstances, things can unfold in a few different ways. If you’re facing a financial hardship and…

There are plenty of good debt-relief programs out there. There are also plenty of bad ones. If consumers do their homework and stick to their programs, there is indeed relief…

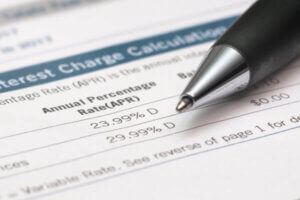

When you’re in the market for a new credit card or taking time to assess the card(s) you already have, one of your key points of analysis should be the…

As a credit expert and a former NFCC-certified credit counselor, I know firsthand that many people are confused about what goes into their credit scores. So, I want to break…

What Is Credit Counseling? Credit counseling is a free service that provides help with budgeting, solutions for becoming debt-free, and tips for managing your money successfully. Credit counseling is offered…

Anyone enduring, or anticipating, the financial squeeze of personal bankruptcy may rightly wonder whether there is life on the other side of this wringer. The good news is there is,…

Sources:

- (2023, November) Fixing your credit FAQs. Retrieved from https://consumer.ftc.gov/articles/fixing-your-credit-faqs#repair

- (2025, June 24) How to repair your credit. Retrieved from https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/how-to-rebuild-your-credit/

- (2025, September 5) What is a credit monitoring service? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-monitoring-service-en-1365/