A Word From Our CEO

This will be my first full year as CEO at InCharge Debt Solution and I’m going to say very confidently – It’s going to be a good one!

When I arrived in May of 2023, the most encouraging thing I found was that the people working at InCharge put the best interests of our clients at the forefront of what we do. People come to us at a very challenging point in their lives. They are scared. They are overwhelmed. They want someone to listen, and care about their financial problems.

The team at InCharge cares and it shows in everything we do.

We listen to our clients’ problems, then educate them on how to solve those issues, manage their money and eliminate debt. We tell people that their dreams matter, and we are committed to helping them make those dreams come true.

We mean it when we say we care.

The 97% approval rating we have from client reviews is earned. I’m impressed with the team and last year’s accomplishments.

We provided 73,461 free budget and credit counseling sessions. We helped our clients pay off more than $100 million in debt. Our websites received 7 million visits from people hungry for a full financial literacy education, interactive calculators, tips, and advice. They got what they came for!

The outlook for 2024, like our logo, is bright and sunny. We are busy transforming new ideas into workable programs that improve the lives of the people serve.

We plan to fully participate in the American dream of homeownership by expanding our housing counseling department. We’re building more features and flexibility to our debt management program and renewing our focus on community outreach and education.

We are looking at adopting new ways to meet our clients where they are with innovative technology and easier ways to reduce consumer debt.

In 2024, InCharge leadership plans to revolutionize our systems and position ourselves for growth by evolving from the inside out. Our management team is focused on three key initiatives for 2024:

- Building additional product lines and revenue streams to ensure we meet the multi-faceted needs of our clients.

- Refining our technology systems to create a better user experience and allow clients access to more benefits and features.

- Focusing more attention on our employees and the work culture at InCharge. We want to promote opportunities for every worker to develop a career path at InCharge.

Finally, we want to step outside our office and take the message of debt-relief service to the surrounding community in Orlando and across the U.S.

That will be a challenge, but I see it as an opportunity. I believe everyone in the InCharge family sees it that way. We have an opportunity to make a difference in people's lives.

And that is what InCharge is going to do in 2024.

InCharge 2023 Fast Facts

0 Million

0

0

0

0

0

0

$0

Our Most Likely Client

The average InCharge client is a female with some college education, who rents her residence and has an average credit score of 532.

0%

0%

0%

0

0%

0%

Top Social Services Referral Categories

InCharge credit counselors connect financially distressed consumers to essential services. Below are the top 5 categories of need for InCharge clients.

Counselor Spotlight

Carolyn Green

If you bump into Carolyn Green at a company function, don’t ask her what she does at InCharge Debt Solutions. Ask her what she hasn’t done!

Her long career in helping people find debt-relief solutions for their financial problems is more than a touch ironic. When she showed up for her first day of training at InCharge Debt Solutions, it would have been easy to ask whether she should be talking about becoming a client, not a credit counselor.

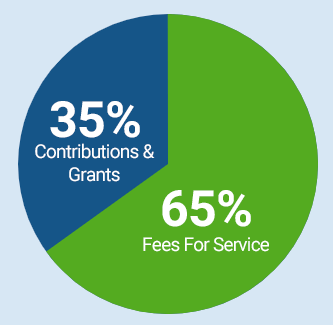

Funding Sources

Customers Served by Program

0%

0%

0%

On Our Way to Debt Free

How InCharge Is Helping Our Family

Rebecca Brady didn’t do anything extravagant to get into debt. It was just everyday life. “It was just our own stupidity, really,” Rebecca said. “It’s not like we were out charging for vacations or expensive jewelry.”

Brady, a wife, and mother of three grown children, got into debt the way millions of people do, and “stupidity” has nothing to do with it. Living real life has everything to do with it.

Our Services

We deliver the highest quality counseling and educational services to consumer groups including military families, students, teachers, employers and employees.

Budget & Credit Counseling

Professional, certified counselors deliver one-on-one counseling on developing budgets, managing money, using credit wisely and building a savings plan.

Debt Management Programs (DMP)

Our debt management program helps clients pay off their credit card debt, typically, in 3-5 years with lower interest rates and a consolidated monthly payment.

Housing Counseling

InCharge Debt Solutions is an approved U.S. Department of Housing and Urban Development (HUD) counseling organization and offers Housing Counseling services to consumers, in person, via telephone, and online.

Bankruptcy Counseling & Education

InCharge and its affiliates have provided over 1 million bankruptcy course sessions since 2006.

Financial Literacy Education

Financial literacy programs are customized for students, teachers, the military, debt-distressed and low-income clients.

Financial Literacy Initiatives

InCharge Debt Solutions is committed to the development and deployment of a wide range of educational resources to foster financial literacy among various consumer groups.

Financial literacy workshops are conducted in partnership with many organizations. In 2023, InCharge participated in 35 community workshops and conferences, touching 956 people.

Ally Wallet Wise Workshops

InCharge is proud to offer Ally’s Wallet Wise program to consumers looking to improve their financial health. Free workshops teach budgeting, responsible use of credit, banking basics and smart auto financing.

Train the Trainer

InCharge reaches thousands of teachers and students with free financial literacy curriculum, available for download on InCharge.org. Our “Resources for Teachers” portal received 118,000 visits in 2023, which includes lesson plans, worksheets and teacher presentation materials.